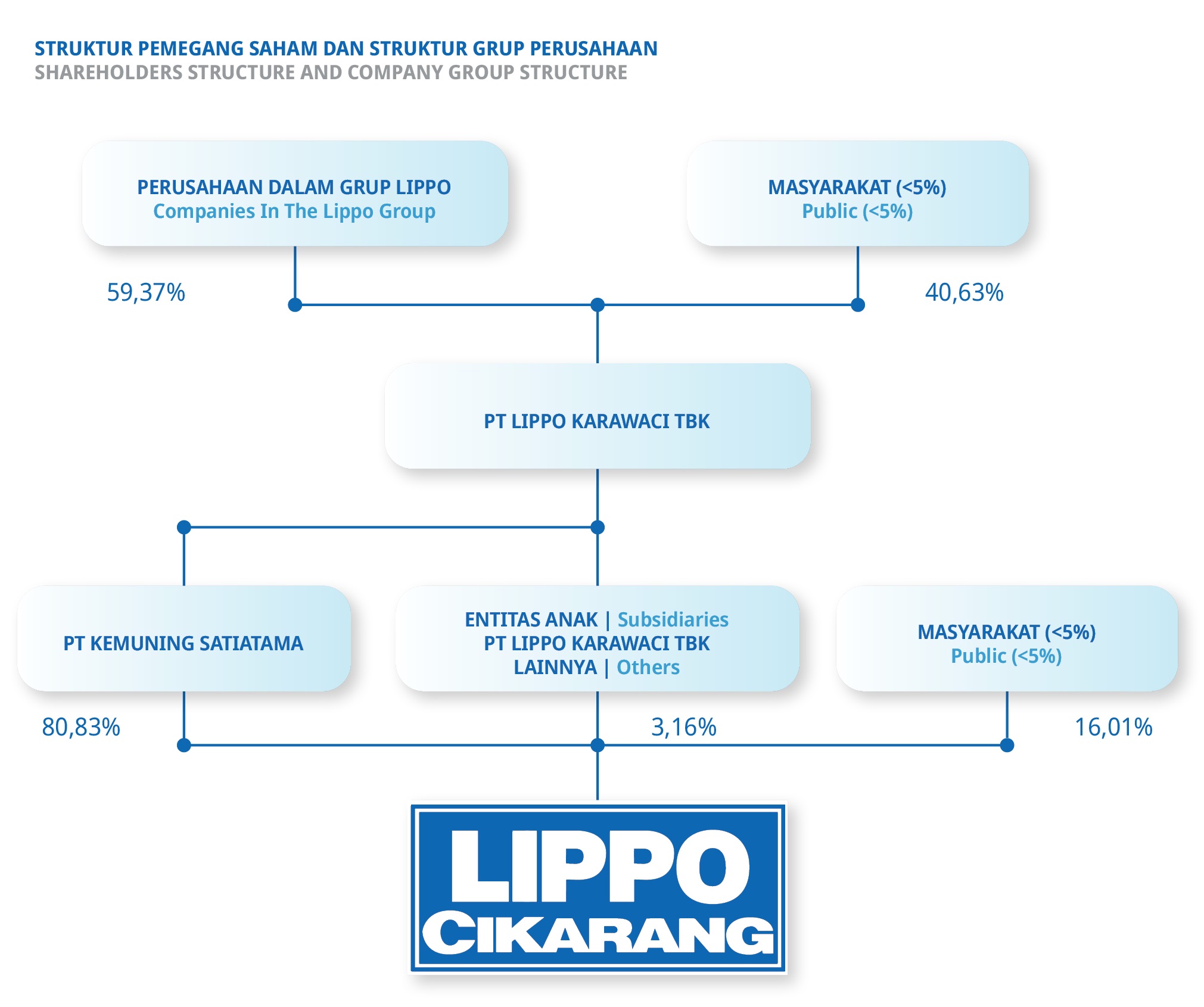

The Composition of Shareholders as of Mar 31, 2025

| No | Shareholders | Number of Shares | Percentage of Ownership |

|---|---|---|---|

| TOTAL | 2.679.600.000 | 100,00% | |

| 1 | PT Kemuning Satiatama | 2.165.811.178 | 80.83% |

| 2 | Public (below 5%) | 513.788.822 | 19.17% |

Controlling Shareholder

PT Kemuning Satiatama is the subsidiary owned by PT Lippo Karawaci Tbk, one of the largest property company in Indonesia and listed on Indonesia Stock Exchange.

Share Ownership by members of The Board of Commissioners and Board of Directors

None of the members of the Board of Commissioners and the Board of Directors has share ownership in the Company.

Dividend History:

| Year | Detail |

|---|---|

| 2021 | Based on the Circular Resolution Board of Commissioners of the Company dated August 30, 2021, the Board of Commissioners has approved the Resolution of the Board of Directors of the Company dated August 23, 2021 Regarding the Interim Cash Dividend Distribution for the 2021 financial year (for the period ending 30 June 2021) to Shareholders. a total dividend for 2021 of Rp150,058,000,000 or Rp56 (in full Rupiah) per ordinary share was approved. The cash dividend has been paid amounted Rp150,013,000,000 on September 22, 2021. |

Securities Issued:

Securities issued by the company is stock, no bonds issued.

SHARE ADMINISTRATION BUREAU

PT Sharestar Indonesia

Berita Satu Plaza 7th Floor

Jl. Gatot Subroto Kav. 35-36

Jakarta 12950, IndonesiaTelephone. (62 21) 527 7966

Fax. (62 21) 527 7967

| Detail | Eng | Ind |

|---|---|---|

| For the Three Months Periods Ended March 31, 2025 | Download | Download |

| For the year ended 31 December 2024 | Download | Download |

| For the 9 (nine) months period ended 30 September 2024 | Download | Download |

| For the 6 (six) months ended 30 June 2024 | Download | Download |

| For the 3 (three) months ended 31 March 2024 | Download | Download |

| For the year ended 31 December 2023 | Download | Download |

| For the 9 (nine) months period ended 30 September 2023 | Download | Download |

| For the 6 (six) months period ended 30 June 2023 | Download | Download |

| For the 3 (three) months ended 31 March 2023 | Download | Download |

| For the year ended 31 December 2022 | Download | Download |

| For the 9 (nine) months period ended 30 September 2022 | Download | Download |

| For the 6 (six) months ended 30 June 2022 | Download | Download |

| For the 3 (three) months ended 31 March 2022 | Download | Download |

| For the year ended 31 December 2021 | Download | Download |

| For the 9 (nine) months period ended 30 September 2021 | Download | Download |

| For the 6 (six) months period ended 30 June 2021 | Download | Download |

| For the 6 (six) months ended 30 June 2021 | Download | Download |

| For the 3 (three) months ended 31 March 2021 | Download | Download |

| For the year ended 31 December 2020 | Download | Download |

| For the 9 (nine) months ended 30 September 2020 | Download | Download |

| For the 6 (six) months ended 30 June 2020 | Download | Download |

| For the 3 (three) months ended 31 March 2020 | Download | Download |

| For the year ended 31 December 2019 | Download | Download |

| For the 3 (three) months ended 31 March 2019 | Download | Download |

| For the 9 (nine) months ended 30 September 2019 | Download | Download |

| For the 6 (six) months ended 30 June 2019 | Download | Download |

PUBLIC ACCOUNTING FIRM

Amir Abadi Jusuf, Aryanto, Mawar & Rekan

AAJ Associates

Plaza ABDA 10th & 11th Floor

Jl. Jend. Sudirman Kav. 59

Jakarta 12190, Indonesia

Telephone: (62 21) 5140 1340

Website: www.rsm.aajassociates.com

| Date | Detail | Ind | Eng |

|---|---|---|---|

| 2024 | Annual Report | Download | Download |

| 2023 | Annual Report | Download | Download |

| 2022 | Annual Report | Download | Download |

| 2021 | Annual Report | Download | Download |

| 2020 | Annual Report | Download | Download |

| 2019 | Annual Report | Download | Download |

| Year | Name | Ind | Eng |

|---|---|---|---|

| 2025 | Prospectus 2025 | Download | Download |

| 2019 | Prospectus 2019 | Download | Download |

| 1997 | Prospectus 1997 | Download | Download |

| PT Lippo Cikarang Tbk | |

|---|---|

| Stock Code | LPCK (Listed on the Indonesian Stock Exchange) |

| Registration No. | 100716800191 |

| Type of Business | Urban development which includes development of real estate and industrial estate, development of infrastructure and public facilities, and providing supporting services |

| Website | www.lippo-cikarang.com |

| Year of Establishment | 1987 |

| First trade date | 24 July 1997 |

| Headquarter Address | Easton Commercial Centre, Jl. Gn. Panderman Kav. 05, Lippo Cikarang – Kab. Bekasi 17550 |

| Authorized Capital | Rp 1.350.000.000.000 |

| Paid-up Capital | Rp 1.339.800.000.000 Comprised of 2.679.600.000 shares |

| Par value | Rp 500 par value |

| Fiscal year | January 1 – December 31 of each year |

| Shareholders | PT Kemuning Satiatama holds approximately 80.83% of shares and Public <5% = 19.17% (as of Mar, 31 2025) |

| Contacs | Corporate Secretary Office Tel. 62-21 897-2484, 897-2488 Fax 62-21 897-2093, 897-2493 Email: corsec@lippo-cikarang.com Corporate Communication Tel. 62-21 897-2484, 897-2488 Fax 62-21 897-2093, 897-2493 Email: corporate.communication@lippo-cikarang.com |

| Date | Category | Detail | Ind | Eng |

|---|---|---|---|---|

| 2025 | Annual GMS | Summary of Minutes of The Annual General Meeting of Shareholders | Download | Download |

| Fourth Agenda Material – CV of Candidates for Members of BOD | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| Proxy Form | Download | Download | ||

| EASY.KSEI Application Guideline | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2024 | Extraordinary GMS | Summary of the Minutes of The Extraordinary General Meeting of Shareholders | Download | Download |

| Rules of Conduct | Download | Download | ||

| Proxy Form | Download | Download | ||

| EASY.KSEI Application Guideline | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Amendment to the Annoucement In Relation To The Schedule of Extraordinary General Meeting of Shareholders | Download | Download | ||

| Announcement of Extraordinary General Meeting of Shareholders | Download | Download | ||

| 2024 | Annual GMS | Summary of Minutes of The Annual General Meeting of Shareholders | Download | Download |

| Proposed Amendment to the Company’s Articles of Association | Download | Download | ||

| Fourth Agenda Material – CV of Candidates for Members of BOD | Download | Download | ||

| Explanation and Material of the Meeting's Agenda | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| EASY.KSEI Application Guideline | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2023 | Extraordinary GMS | Summary of Minutes of The Extraordinary General Meeting of Shareholders | Download | Download |

| Proxy Form | Download | Download | ||

| Explanation and Material of the Meeting's Agenda | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| EASY.KSEI Application Guideline | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Extraordinary General Meeting of Shareholders | Download | Download | ||

| 2023 | Annual GMS | Minutes of Meeting (Notarial Deed) dated 15 June 2023 | Download | Download |

| Video Documentation of the Meeting | Download | Download | ||

| Summary of Minutes of The Annual General Meeting of Shareholders | Download | Download | ||

| Explanation and Material of the Meeting - Fifth Agenda | Download | Download | ||

| Explanation and Material of the Meeting - Fourth Agenda | Download | Download | ||

| Explanation and Material of the Meeting - Third Agenda | Download | Download | ||

| Explanation and Material of the Meeting - Second Agenda | Download | Download | ||

| Explanation and Material of the Meeting - First Agenda | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| Proxy Form | Download | Download | ||

| EASY.KSEI Application Guideline | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2022 | Annual GMS | Summary of Minutes of the Annual General Meeting of Shareholders | Download | Download |

| e-Voting KSEI Guideline Video | Download | Download | ||

| eASY.KSEI Application Usage Guideline | Download | Download | ||

| Proxy Form | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| Explanation and Material of the Meeting – Fifth Agenda | Download | Download | ||

| Explanation and Material of the Meeting – Fourth Agenda | Download | Download | ||

| Explanation and Material of the Meeting – Third Agenda | Download | Download | ||

| Explanation and Material of the Meeting – Second Agenda | Download | Download | ||

| Explanation and Material of the Meeting – First Agenda | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2021 | Extraordinary GMS | Summary of Minutes of the Extraordinary General Meeting of Shareholders | Download | Download |

| e-Voting KSEI Guideline Video | Download | Download | ||

| eASY.KSEI Application Usage Guideline | Download | Download | ||

| Proxy Form | Download | Download | ||

| Explanation and Material of the Meeting's Agenda | Download | Download | ||

| Agenda Material – CV of Candidates for Members of BOD and BOC | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| Invitation of the Meeting | Download | Download | ||

| Announcement of Extraordinary General Meeting of Shareholders | Download | Download | ||

| 2021 | Annual GMS | Summary of Minutes of the Annual General Meeting of Shareholders | Download | Download |

| Specific Provision on the Implementation of Strengthening Micro PPKM and Prevention of the Spread of Covid19 Virus | Download | Download | ||

| Explanation and Material of the Meeting | Download | Download | ||

| Proposed Amendments to the Company’s Articles of Association | Download | Download | ||

| Fourth Agenda Material – CV of Candidates for Members of BOD | Download | Download | ||

| eASY. KSEI Application Usage Guideline | Download | Download | ||

| Guidance of e-Vote System (Registar) | Download | Download | ||

| Proxy Form | Download | Download | ||

| Rules of Conduct | Download | Download | ||

| Invitation of Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2020 | Annual GMS | Summary of Minutes of the Annual General Meeting of Shareholders | Download | Download |

| Rules of the Annual General Meeting of Shareholders | Download | Download | ||

| Explanation of Agenda of Annual General Meeting of Shareholders | Download | Download | ||

| Invitation to the Annual General Meeting of Shareholders | Download | Download | ||

| Information Regarding Independent Attorney-in-Fact | Download | Download | ||

| Power Of Attorney of Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| Postponement of the Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of the Postponement of the Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| 2019 | Extraordinary GMS | Summary of Minutes of Extraordinary General Meeting of Shareholders | Download | Download |

| Explanation of Agenda of the Extraordinary General Meeting of Shareholders | Download | Download | ||

| Power Of Attorney Of Extraordinary General Meeting of Shareholders | Download | Download | ||

| Invitation to Extraordinary General Meeting of Shareholders | Download | Download | ||

| Announcement of Extraordinary General Meeting of Shareholders | Download | Download | ||

| 2019 | Annual GMS | Summary of Minutes of the Annual General Meeting of Shareholders | Download | Download |

| Explanation of Agenda of Annual General Meeting of Shareholders | Download | Download | ||

| Power Of Attorney of Annual General Meeting of Shareholders | Download | Download | ||

| Invitation to the Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of Annual General Meeting of Shareholders | Download | Download | ||

| Changes in Schedule for Annual General Meeting of Shareholders | Download | Download | ||

| Announcement of the Annual General Meeting of Shareholders | Download | Download |

The current dividend policy of the Company is:

| Net Income | Percentage of Cash Dividend to Net Income |

|---|---|

| Up to Rp 800 billion | up to 10% |

| Over Rp 800 billion | 10% up to 30% |

Corporate Secretary/Investor Relations

PT Lippo Cikarang Tbk

Tel: (62-21) 8972484 / 8972488

Email: corsec@lippo-cikarang.com, Investor.Relations@lippo-cikarang.com

Website: www.lippo-cikarang.com